Financial wellbeing service design

Assemble Futures offers a new pathway to home ownership – bridging the gap between renting and owning your home. Assemble’s promise to customers includes complimentary financial coaching to help them save towards a deposit on their own home.

While at Paper Giant, I led this project to research, design and test an effective and scalable model of financial coaching to offer the Assemble community.

Designing a brand new financial coaching service

We crafted a new financial coaching service from scratch by engaging residents, service providers and subject matter experts in research and design activities. We found out what Assemble’s customers wanted, what type of service they would actually engage with, and what would help them on their pathway to homeownership.

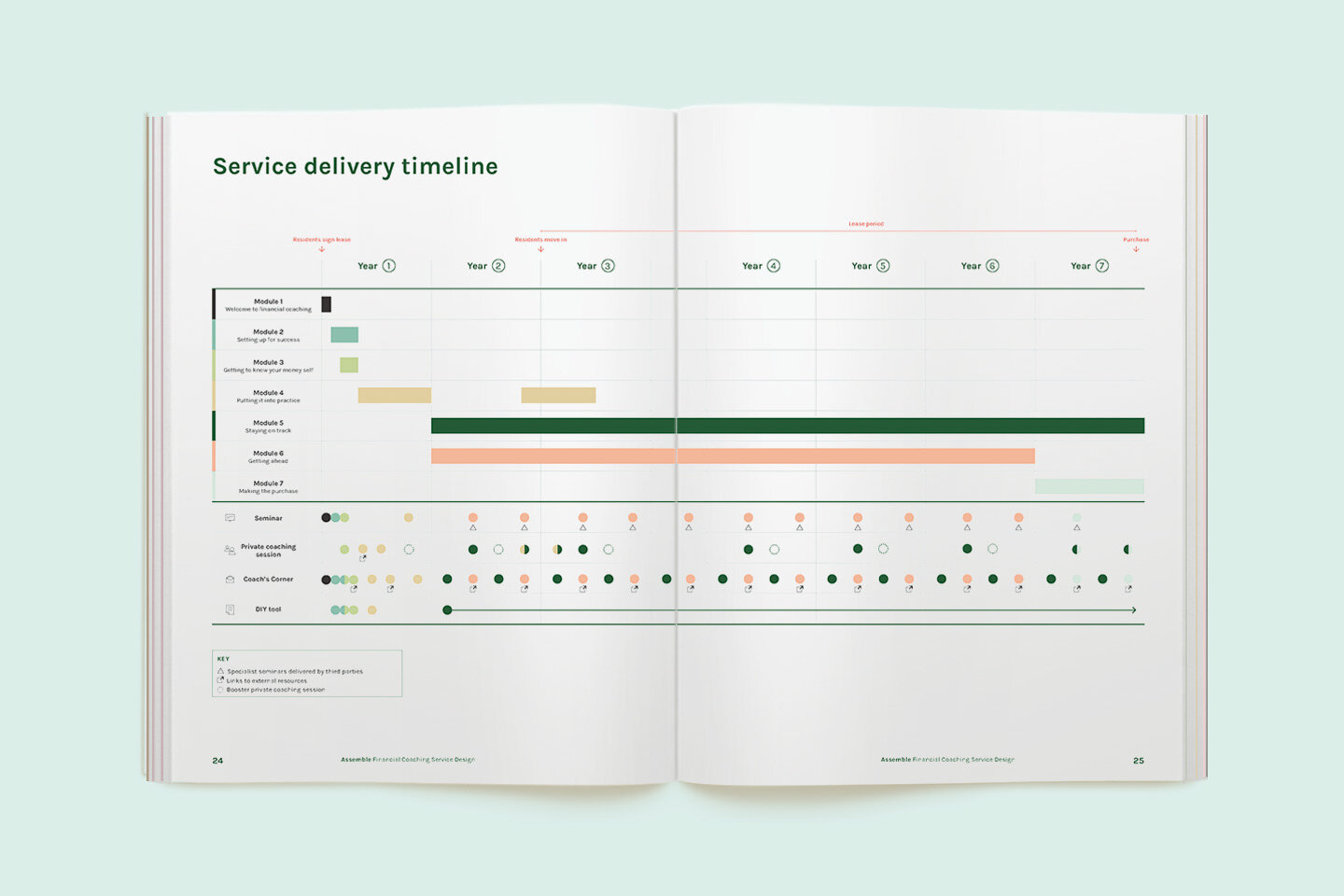

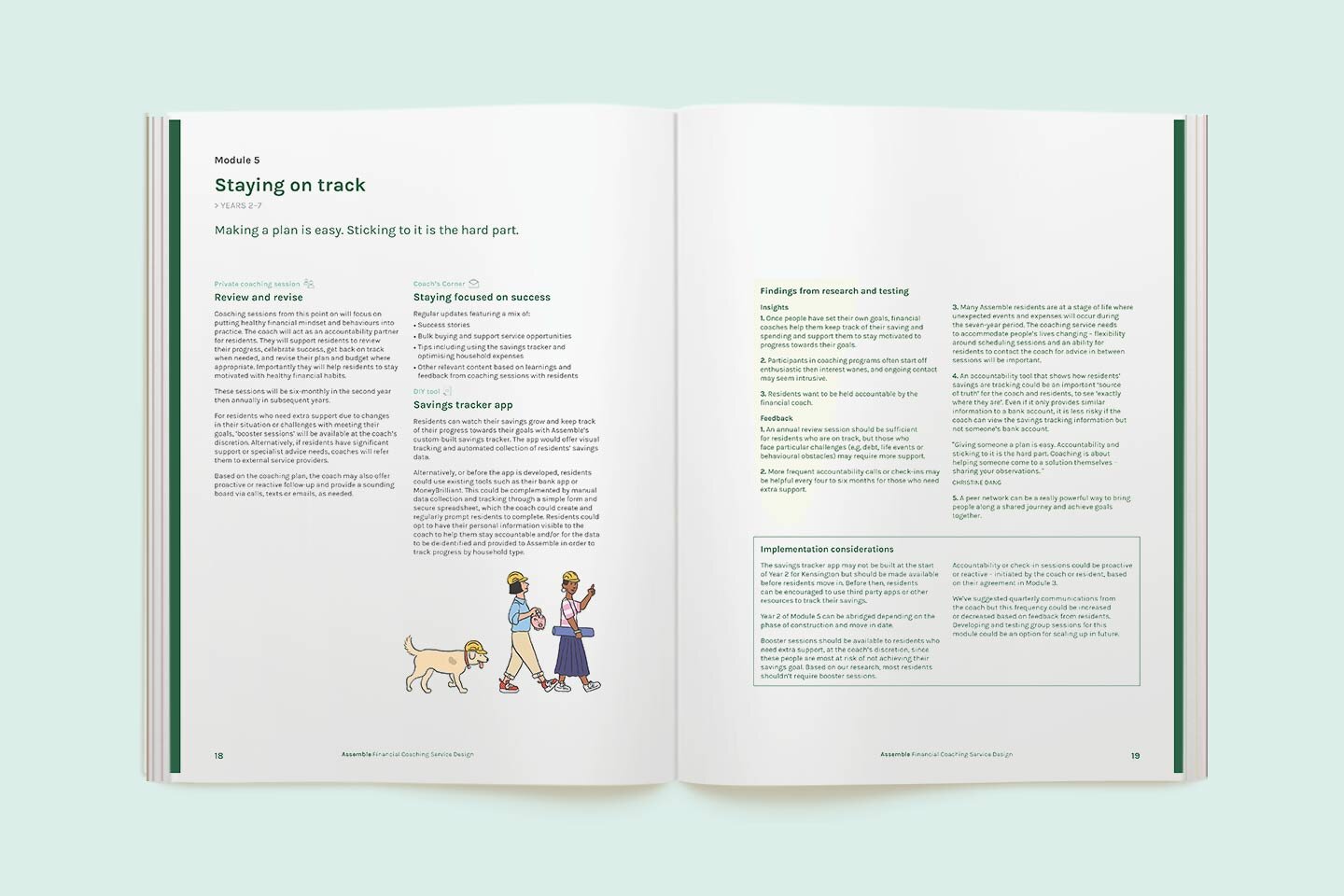

My team developed, tested and iterated a service model comprised of seven learning modules and a variety of tools and activities that residents could select and adapt to suit their needs. The implementation strategy includes recommendations for meeting residents’ emotional and behavioural needs, including how to space out sessions to avoid overwhelming customers with too much information at once. I also delivered an accompanying evaluation framework and detailed position description for the new role of financial coach.

Making immediate implementation easy

Our well-informed and practical guidance enabled Assemble to quickly recruit a Community Financial Coach to finalise the service model and begin supporting residents on their journey to financial wellbeing. Assemble Futures staff now use the framework as a ‘playbook’ for effectively engaging with residents who are saving for a deposit and building financial wellbeing while enjoying life in their new home.